Partners for Life Sciences.Digital Healthcare.Med-Tech.Impact.

We are Life Science Vision Capital.

We are a global multi-stage investment firm focused on life sciences, healthcare, med-tech and social impact.

We support entrepreneurs from pre-seed to later-stages.

About us

We are a global multi-stage investment firm helping entrepreneurs building for the future of healthcare and life sciences from pre-seed to later stages with presence in London, Bengaluru, Tel-aviv, San Francisco and currently expanding into Oslo and Rhineland. We commit to long-term partnerships with entrepreneurs who are as passionate as we are about pushing the frontiers of innovation to contribute to a better future. We strongly believe that turning science into business is about recognizing opportunity and at Life Science Vision Capital Partners, we focus on breakthrough innovations that have the potential to solve the world's most pressing problems.

We invest in people and science to create opportunity.

Sectors

Digital Healthcare

We define Digital Health as a wide range of sectors: mHealth, Home Care, DTx, Remote Patient Monitoring and Care, Healthcare IT, Monitoring devices, I.o.T, Tele-health, Big Data, Image Processing and more.

Biotech & Bio-Pharma

Supporting breakthroughs that have the power to change the lives of billions

Med Tech

The future of medtech resides in the shifts from intervention to prevention, invasive to non-invasive and hospitals to the home.

AI, VR & Digital Twins

Building infrastructure capacity for the future of health.

"We are not giving thumbs up or down as entrepreneur pitch us their businesses rather we understand their needs, bring in external assets and help navigate complex healthcare landscape. We cross challenges together. We create companies together"

Shu Joshi, Managing Partner

Quick overview

0+

0mn

0

0k

What's new

[ditty id=9605]

Healthcare in complex.

Our strategy for selecting healthcare investments and adding value is proven and agile. We invest across stages, geographic regions, and sectors, with expertise spanning biotechnology, bio-pharma, healthcare IT, AI, DML, AR/VR, medical technology and synthetic biology.

We are active across the entire value chain of life sciences investments, from seed to later-stage, with a focus on healthcare, impact and sustainability. Each of our funds is a manifestation of our ability to recognize opportunity and unlock its potential with a dedicated team and a tailored strategic approach.

Our basic Investment principles

We typically invest between $1m to $10m over a venture’s lifetime, with a first investment between $500k to $5m.

We take minority ownership stakes, usually between 5-25%. We play from (pre-) seed funding through IPO, as long as there is a good strategic fit.

We can lead rounds or follow another investor’s lead. We prefer to syndicate deals to ensure there is sufficient working capacity for future rounds.

We are active partners and usually offer to serve on the Board of the start-ups in our portfolio.

Our goal is to transform healthcare

one investment at a time.

By supporting diverse entrepreneurs who create and build breakthrough companies and treatments.

Our Venture Studio and Accelerator

Introducing Health Incubate Venture Studio

Say ``Hi``. Health Incubate is our inhouse venture studio platform. The team’s hands-on entrepreneurial expertise contributes to the platform's global leadership in company building. We are serial entrepreneurs using a unique model to discover and nurture ground-breaking ideas for digital therapeutics, connected healthcare, medical devices and bio-therapeutics.

Portfolio

![]()

![]()

![]()

![]()

XHealth Innovation Labs

Xhealth Innovation Labs

Our partnership with NSE public listed healthcare group Aster DM Healthcare resulted in the launching of Xhealth Innovation Labs, a unique program focused on clinicians and digital healthcare startups in India and GCC.

More here: Aster DM Healthcare

Press: Economic Times, Deal Street Asia, Express Healthcare, Inc42

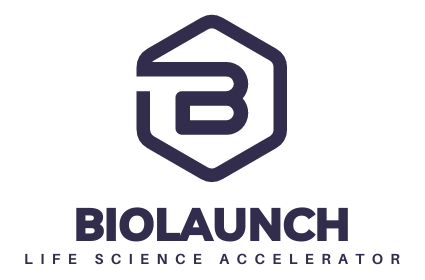

Our Life Science Accelerator

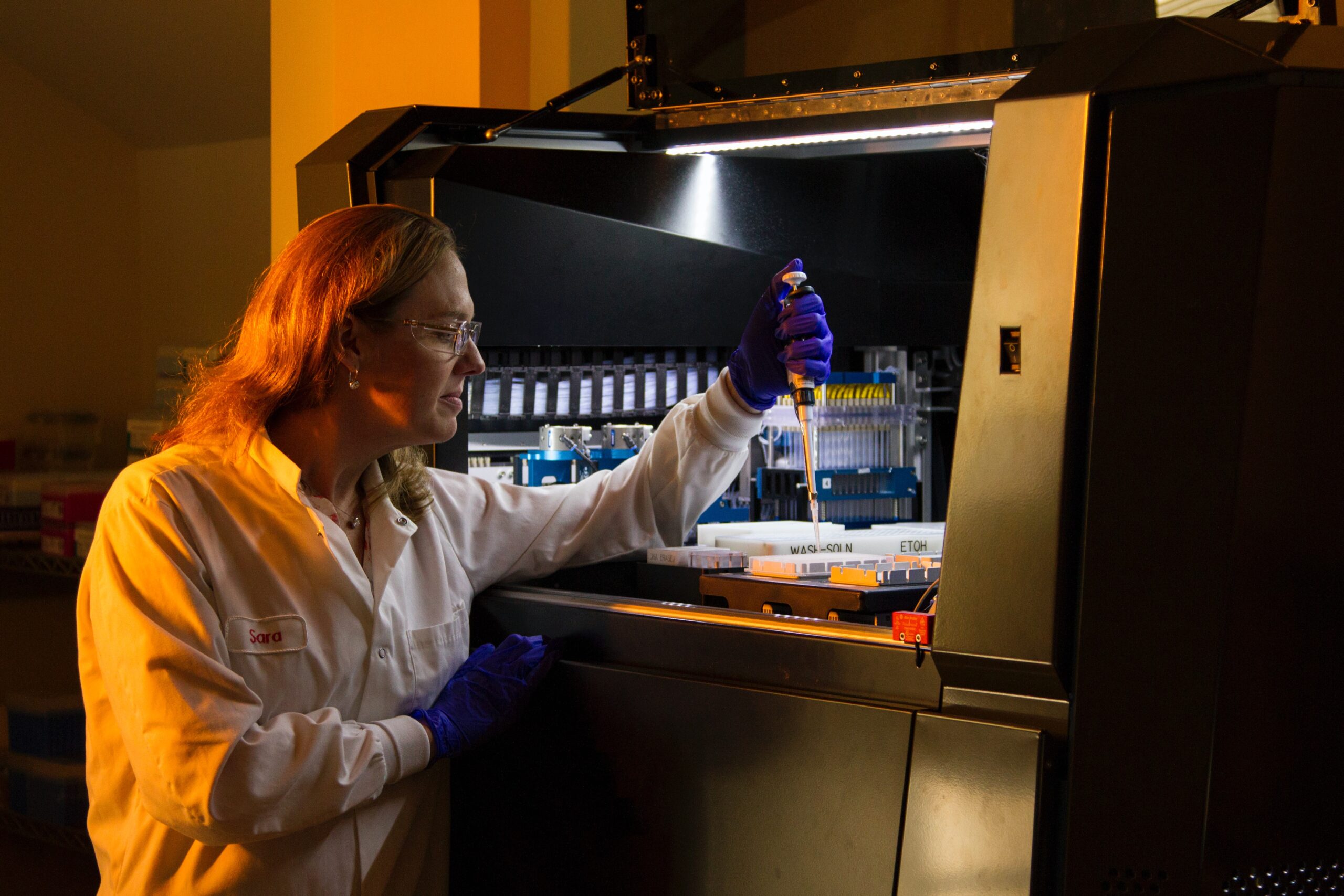

Launching BioLaunch Accelerator

Our life science accelerator. BL operates an accelerator to support world-class life science innovation that drives the development of new solutions by early-stage life science start-ups for the benefit of people and society.

The Startup Nation: Israel

LSV Israel Fund I

Dedicated fund for Pre-Seed/Seed/Series A investments bringing together Israeli and European ecosystems closer for advancement of healthcare and life science innovation.

Our Team

We are driven by our talented team and network. We bring together our experienced investment professionals with healthcare industry veterans to build value in breakthrough life sciences companies.

Mr. Steve Jacobs

General Partner & CFO

Steven Jacobs is General Partner and CFO. With strong Bio-pharma M&A background, Steve has previously anchored deals in excess of $10bn while working for Switzerland basedL Partner Group. His alma mater includes CalTech (USA) and Insead (France)

Mr. Shu Joshi

Managing General Partner

Shu Joshi is a seasoned fund manager with 15+ years of work experience in PE/VC, corporate strategy, mergers, acquisitions and entrepreneurial set-ups spanning across multiple geographic locations including UK, Europe, and the USA covering medical device, biopharmaceutical, and healthcare sector. His alma mater includes University College London (UK) and Stanford Graduate School of Business (USA)

Our Venture Partners, Advisors and Executive Team

Dr. Nick Ivery

Venture Advisor, UK

Dr. Satish Rath

Industry Advisor, India

Dr. K Krishanmurthy

Consultant, USA

Dr. Amit Pareekh

Consultant, UK

Mr. Pradeep K

Business Support Function, India

Ms. Aishwarya Mahesh

Social Media & Events Manager, India

Ms. Nicole Lynn

Investment Lead, UK

Are you building for the future of health & care?

We would like to hear from you.

[ditty id=9750]